Behind The Curtain.

It is my practice not to write two blogs about the same topic in order to avoid repetition. But DOGE has so many moving parts that it requires a second look. (Click here to see the first blog, Elon Musk Must Deal With An Oxymoron, A Swamp, and An Octopus.)

When the curtain is pulled back in The Wizard of Oz, the wizard is exposed as an ordinary man shielded by a facade. DOGE has the same trait. Unfortunately, I do not know how to pull back the curtain.

Do not misunderstand. I am delighted that President Trump, through Elon Musk's efforts, is attempting to eliminate fraud and inefficiency in government, thus saving billions of dollars. For years, I have complained that government is inefficient, a lesson I learned while working in government. (Business people, like me, complain that the government is not efficient; in fairness, it needs to be pointed out that many businesses also are not efficient.)

Transparency.

I have examined the DOGE.gov website to try to become informed. However, like so many governmental projects, it is not transparent.

The website for DOGE says it is producing savings by:

This statement says a lot, and yet it is so general it says nothing at all. Since we cannot look behind the curtain, I offer the following as examples of areas that require transparency.

How Do You Evaluate Doge?

The first thing to consider is why we have DOGE. Is the real purpose to root out inefficiency, keep a campaign pledge, reduce the national debt, or establish a model that future White House teams can follow? The website does not do a good job of explaining the overarching purpose of DOGE. Maybe it is all four, but as will be discussed below, using DOGE to reduce the national debt significantly is not a realistic goal.

Secondly, how are the savings being ascertained? For example, if DOGE says that it has saved $2,000,000,000 by canceling contracts, is the amount determined by measuring the present value of the contracts or just using the aggregate amount of the contracts? Does it make any assumptions that current contracts are open-ended? Does the number assume that the money saved will not have to be put back into the budget by Congress at a future date because the services provided are necessary and will eventually have to be outsourced?

If DOGE claims it has saved $20,000,000 in employee costs, does this include vacant positions that would not have been filled? For example, does it involve positions in departments or areas that have been assumed under another department and are no longer functioning or funded? Does it include positions that were already scheduled to be eliminated?

If DOGE says it has clawed back funds, are these funds that would not have been spent immediately but carried forward for other necessary projects? Does the amount of clawbacks show penalty fees, if any, for canceling contracts?

Even more importantly, are the DOGE savings ongoing? Or are they one-time savings that can be overwhelmed by increased congressional spending?

Third, how is DOGE determining waste? One person may consider a governmental program redundant, inefficient, or ineffective, and another may have a different perspective. Simply put, I cannot tell how DOGE decides an expenditure is inappropriate or wrong.

It would be helpful if DOGE provided a breakdown of how it calculates cost savings. Show me the procedure for calculating the savings and the guidelines for determining if a program is inefficient. Then, I can decide if the dollars saved are appropriately calculated.

Using The Money.

DOGE will theoretically shut down in July 2026; it will supposedly sine die on July 4th. I checked the DOGE.gov website today, and the savings estimate to date is $115 billion over approximately the first two months of operation. We must assume that DOGE is getting the low-hanging fruit first and that the numbers are optimistic. However, to be generous, I will project that the ultimate savings will be nine times this initial number (assuming the savings for the remaining months will be proportional to the savings in the first two months). This calculation produces a total of approximately $1.035 trillion in savings. Indeed, no one can say that I am not fair to DOGE.

An important question is how the funds will be spent. We could send every taxpayer a check for slightly more than $6,400. As a taxpayer, I would like this option, but it does not help solve the long-run debt problem in the United States and would be inflationary. (I am sure most taxpayers would like this option if we took a poll.)

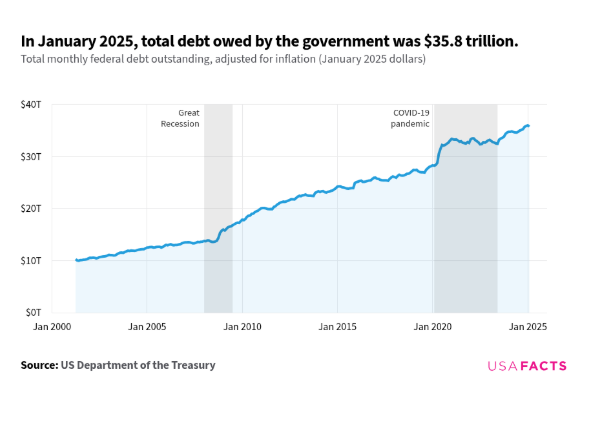

The current national debt is more than $36.6 trillion and will likely increase by another $500 to $600 billion by the end of the 2025 fiscal year, putting it close to $37 trillion. The interest payments this year on the national debt will be close to $970 billion.

The DOGE funds could be used to pay interest costs, leaving the balance to be applied to the national debt. This action would slow but not eliminate the rate of the increase in the national debt.

An alternative would be to use the DOGE funds to pay off the national debt directly. This direct payment would reduce the rate of growth of the national debt for this fiscal year and thus lower the interest costs for the 2025 and 2026 fiscal years. But this is like playing financial Wack-A-Mole. Regardless of how the funds are utilized, they will not significantly reduce the debt and interest payments in the long run.

Does DOGE Matter?

The key issue is whether DOGE matters. The answer is "yes" and "no." If setting an example for future administrations is important, DOGE is important. If the savings DOGE projects can be replicated on an ongoing basis, it is important. If the president wants to show that he has completed a campaign promise, it is important.

However, DOGE cannot save the country from the excessive spending that Congress seems to relish. It could marginally reduce interest costs and/or the national debt. Unfortunately, the national debt will increase by $20 trillion* by 2034, approaching $48 trillion.

A portion of the $20 trillion debt could result from the president cutting tax revenue. The table below shows estimates for the upper and lower boundaries of the president's possible tax cuts. Even the low estimate projects that the tax cuts will reduce governmental revenue by $5 trillion over the next ten years.

Fiscal Impact of Trump's Reported Tax Priorities (2026-2035)**

| Policy | Low Est. | High Est. |

| Extend the Tax Cuts and Jobs Act | $3.9 trillion | $4.8 trillion |

| Provide SALT Relief | $200 billion | $1.2 trillion |

| Cut Taxes on Tips | $100 billion | $550 billion |

| Cut Taxes on Overtime Pay | $250 billion | $3.0 trillion |

| Cut Taxes on Social Security | $550 billion | $1.5 trillion |

| Cut Taxes for Domestic Production | $100 billion | $200 billion |

| Close Carried Interest Loophole, Reduce Tax Benefits for Stadium Owners | -$100 billion | # |

| Total | $5.0 trillion | $11.2 trillion |

See Committee for a Responsible Federal Budget.

What Is Really Needed?

Even if DOGE's projections are correct, the United States will have a major financial challenge by 2045 unless Congress takes significant steps to curb spending. Maybe we need to go back to the Clinton/Gingrich days when we had a balanced budget. The days when different parties controlled the House of Representatives and the White House and the relationship produced the need for compromise and a healthy economy. If we had a balanced budget, DOGE could be the icing on the financial cake.

Picture by U. S. Treasury.

If you have not read the blog that describes the "However View," click here.

*The increase in the national debt through 2034 is not adjusted for inflation.

**Proponents of tax cuts may argue that the tax cuts can generate a net increase in governmental income because of the impact of the Laffer Curve. See Laffer Curve; History and Critique.